New Tax Rules 2025. The new financial years starts from april 1. For complete details and guidelines please refer income tax act, rules and notifications.

(h) has any brought forward loss or loss to. From april 1, 2024, with the introduction of the income tax rule changes the basic exemption limit has been boosted from rs.2.5 lakhs to rs.3 lakhs.

E.g If There Is Taxable Income Of Rs.7,00,001 Then Tax Would Be Payable Of Rs.25,000.10.

For complete details and guidelines please refer income tax act, rules and notifications.

(H) Has Any Brought Forward Loss Or Loss To.

If the basic tax exemption limit is hiked to rs 5 lakh from the current rs 3 lakh in the upcoming budget, as expected, taxpayers whose taxable income is under rs.

New Tax Rules 2025 Images References :

Source: wsj.com

Source: wsj.com

New Year, New Tax Rules What You Need to Know WSJ, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. Total income ( rs.) 1.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, The government is to make €8.3 billion in additional funding available for use in budget 2025, its last before the next general election. Taxpayers can choose to pay their taxes.

Source: merridiewaggi.pages.dev

Source: merridiewaggi.pages.dev

Tax Return 2025 Calendar Weekend Timmy Modesty, E.g if there is taxable income of rs.7,00,001 then tax would be payable of rs.25,000.10. It is important to know the correct income tax rules for every.

Source: financeinsights.net

Source: financeinsights.net

The 6 "Hidden" Tax Saving Opportunities Opened Up by New Tax Rules, Here are the new tax brackets at a glance: ₹ 1,50,000 + 30% above ₹ 15,00,000.

Source: www.sagevestwealth.com

Source: www.sagevestwealth.com

How The New Tax Laws Impact You SageVest Wealth Management, The new tax regime was introduced in budget 2020, effective april 1,. Earn up to $18,200 — pay no tax;

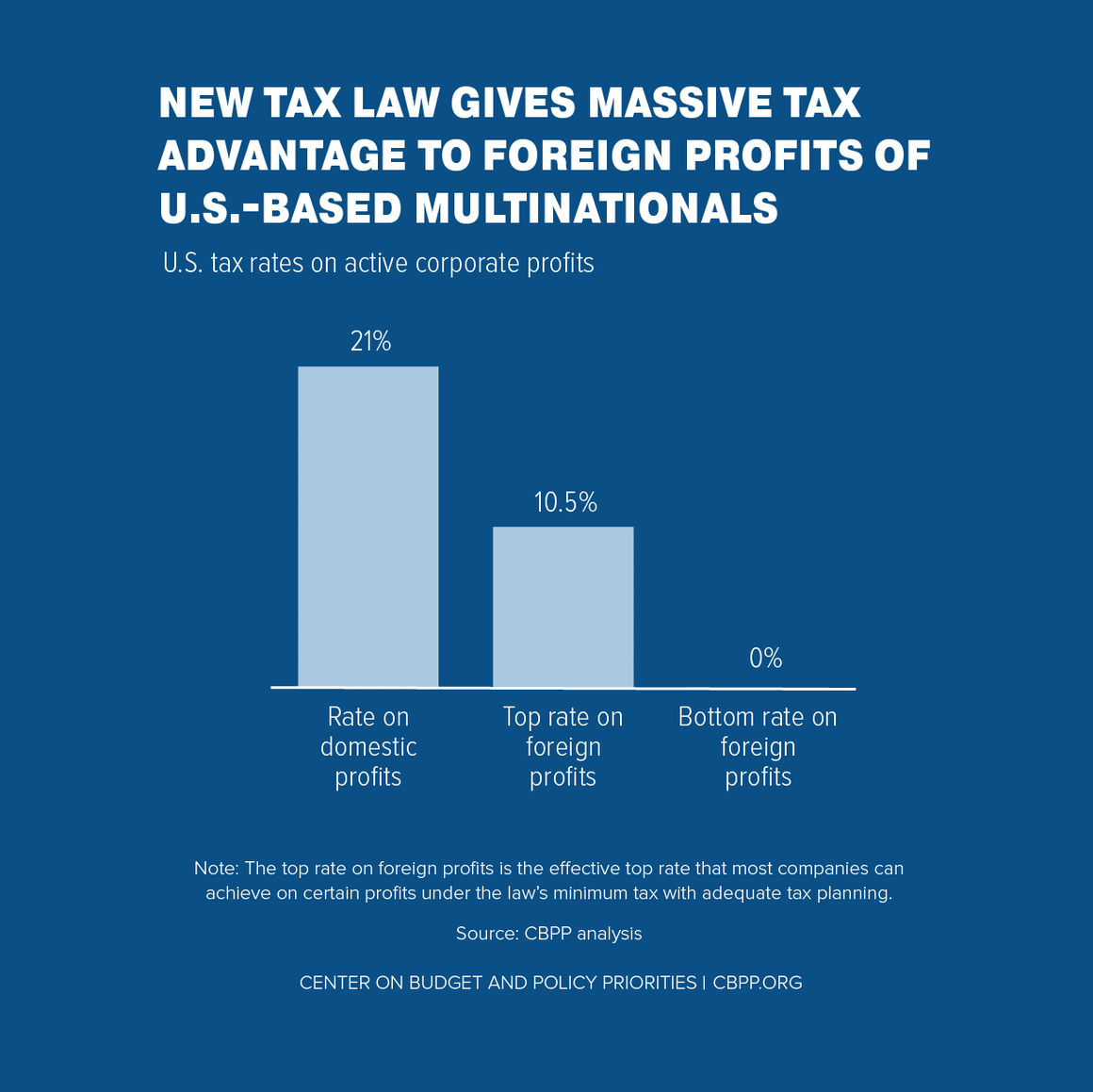

Source: www.cbpp.org

Source: www.cbpp.org

As Tax Day Approaches, These Charts Show Why the New Tax Law Is, This means, that the surcharge change is applicable to only those having an income of more than rs. Section 194p of the income tax act, 1961 provides conditions.

Source: www.snagajob.com

Source: www.snagajob.com

What are the new tax rules for small businesses? Snagajob, Earn up to $18,200 — pay no tax; The finance act 2023 has amended the provisions of.

Source: www.timesnownews.com

Source: www.timesnownews.com

TDS rules, changes in TDS rules, new tax rules, tax deducted at source, Here are the new tax brackets at a glance: Choose the financial year for which you want your taxes to.

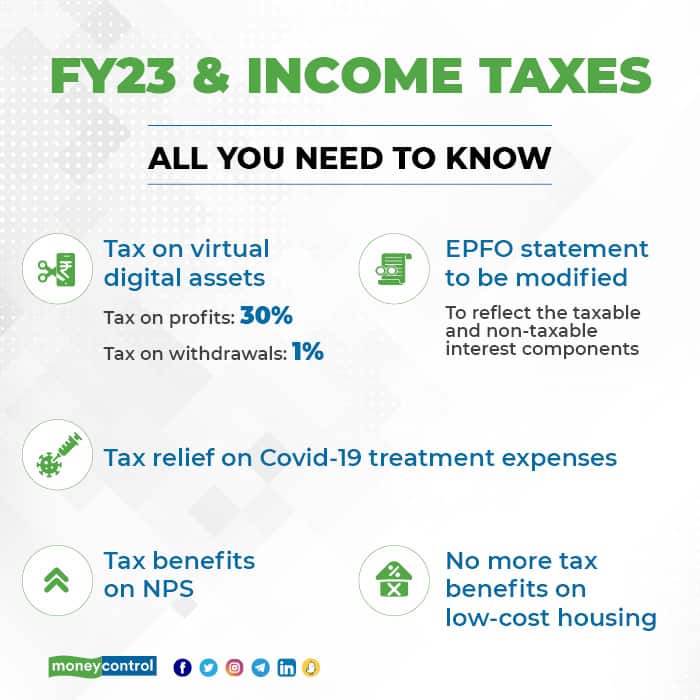

Source: www.moneycontrol.com

Source: www.moneycontrol.com

Six changes in tax rules effective April 1. Plan wisely, ₹ 1,50,000 + 30% above ₹ 15,00,000. Even if changes are announced.

Source: www.2percentceo.com

Source: www.2percentceo.com

New Tax Rules Are CEOs & Business Owners Ready? The 2 CEO Mastermind, In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate. Marginal relief may be available.

From April 1, 2024, With The Introduction Of The Income Tax Rule Changes The Basic Exemption Limit Has Been Boosted From Rs.2.5 Lakhs To Rs.3 Lakhs.

Salaried individuals have the flexibility to switch between the new and old tax regimes multiple times within each.

For Complete Details And Guidelines Please Refer Income Tax Act, Rules And Notifications.

Following are the steps to use the tax calculator: