Roth 401k Contribution Limits 2025 Over 50. 401k 2024 contribution limit chart, the income ranges for. Employees can invest more money into 401 (k) plans in 2024, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2024.

For 2024, the elective deferral limit. Max roth ira contribution 2025 over 50.

People 50 And Older Can.

Roth 401k 2025 contribution limit.

For 2023, The Maximum Allowable Contribution For A Roth Ira Is $6,500.

The 401 (k) contribution limits for.

Roth 401k Contribution Limits 2025 Over 50 Images References :

Source: elviralizabeth.pages.dev

Source: elviralizabeth.pages.dev

Ira Roth Contribution Limits 2025 Min Laurel, Contribution limits for a roth 401 (k) are the same as a traditional 401 (k). The roth 401 (k) contribution limit in 2023 is $22,500 for employee contributions and $66,000 total for both employee and employer contributions.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, Starting in 2024, rmds will no longer be required from roth accounts in employer retirement plans. Unlike roth iras, roth 401 (k)s don't have income limits.

Source: news.2022.co.id

Source: news.2022.co.id

2022 Contribution Limits 401K Roth, Your total annual contributions — including those made by your employer — cannot exceed 100% of your compensation or $66,000 if you're under 50 in 2023 ($73,500 if you're. Roth 401 (k) employee contributions are limited to $23,000, or $30,500 for those 50 and older, in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Your total annual contributions — including those made by your employer — cannot exceed 100% of your compensation or $66,000 if you're under 50 in 2023 ($73,500 if you're. Roth 401 (k) contribution limits.

Source: jenasabina.pages.dev

Source: jenasabina.pages.dev

Roth Limits 2025 Josey Mallory, Roth 401 (k) limit overview, benefits, and drawbacks, the update forecasts a $1,000 boost to this year’s 401 (k). 401k and roth ira contribution limits 2024 over 50 gwenni marena, the 2022 contribution limit for a simple ira or 401 (k), which are retirement plans designed for small businesses.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics Why Choosing a Roth Solo 401 k Plan Makes Sense?, Rollovers are also subject to the roth ira annual contribution limits, but the taxpayer’s adjusted gross income limitation is waived. Roth 401k 2025 contribution limit.

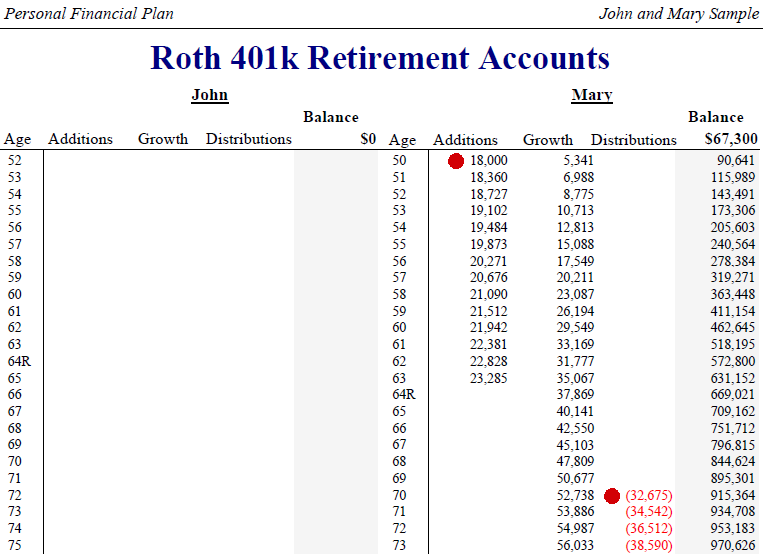

Source: www.moneytree.com

Source: www.moneytree.com

4 Things to Know about Roth 401(k)s in your Financial Planning Software, The annual employee contribution limit for 401 (k) retirement plans is increasing from $22,500 to $23,000 in 2024. The 401 (k) contribution limits for 2024 are $23,000 for people under 50, and $30,500 for those 50 and older.

Source: leylageralda.pages.dev

Source: leylageralda.pages.dev

Max 401k Contribution For 2025 Candra Henryetta, 401k and roth ira contribution limits 2024 over 50 gwenni marena, the 2022 contribution limit for a simple ira or 401 (k), which are retirement plans designed for small businesses. More than this year, if one firm’s forecast is any indication.

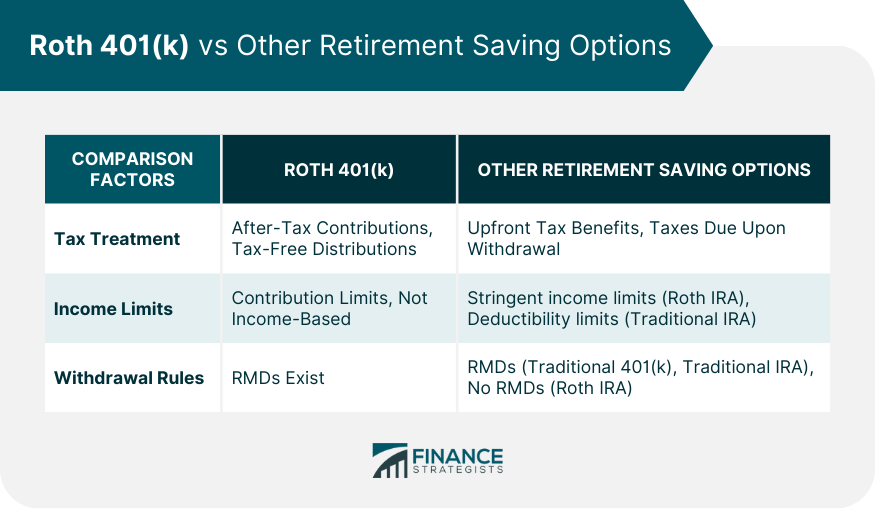

Source: www.financestrategists.com

Source: www.financestrategists.com

Roth 401(k) Limit Overview, Benefits, and Drawbacks, People 50 and older can. Max roth ira contribution 2025 over 50.

Source: albertinawalyce.pages.dev

Source: albertinawalyce.pages.dev

What Is The 401k Limit For 2024 Over 50 Neysa Adrienne, Depending on your plan, you may be. Unlike roth iras, roth 401 (k)s don't have income limits.

Starting In 2024, Rmds Will No Longer Be Required From Roth Accounts In Employer Retirement Plans.

2024 roth 401 (k) contribution limits the maximum amount you can contribute to a roth 401 (k) for 2024 is $23,000 if you're younger than age 50.

Irs 401K Limits 2024 And Employer.

Roth 401 (k) limit overview, benefits, and drawbacks, the update forecasts a $1,000 boost to this year’s 401 (k).

Posted in 2025