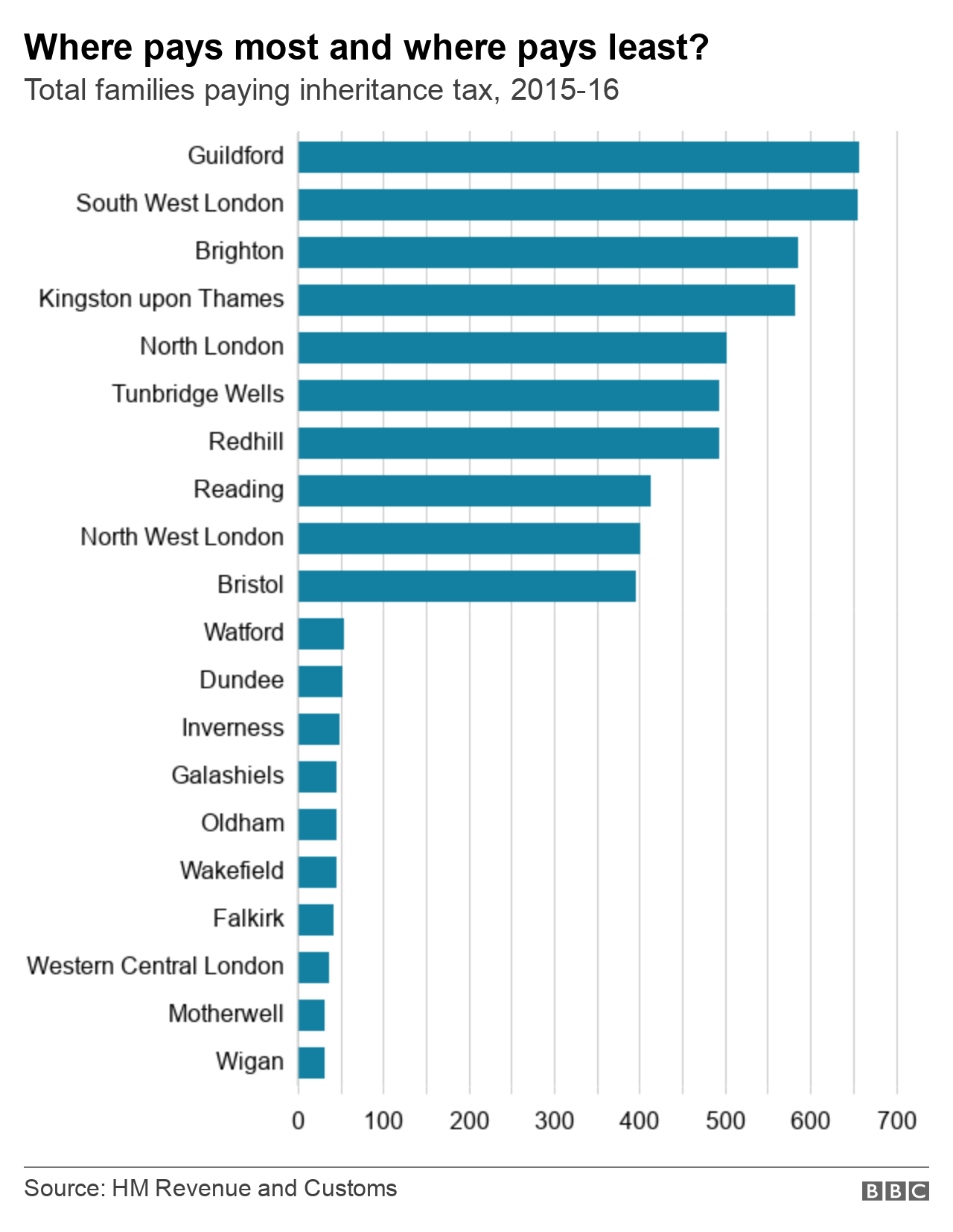

What Is The Inheritance Tax Threshold In 2024. This threshold is known as the nil. Between april 2022 and march 2023, families paid a.

Inheritance tax thresholds and interest rates. Each person’s estate can benefit.

What Is The Inheritance Tax Threshold In 2024 Images References :

Source: wilowdanette.pages.dev

Source: wilowdanette.pages.dev

Threshold For Inheritance Tax 2024 Uk Wally Lillian, Any portion of your estate valued above this amount is taxed at 40%.

Source: kathebkirsti.pages.dev

Source: kathebkirsti.pages.dev

Threshold For Inheritance Tax 2024 Johna Madella, Check if an estate qualifies for the inheritance tax residence nil rate band.

Source: sweetpea.care

Source: sweetpea.care

Inheritance tax threshold Everything you need to know, Work out and apply the.

Source: www.growthcapitalventures.co.uk

Source: www.growthcapitalventures.co.uk

Inheritance tax planning incorporating tax efficient investments GCV, 45 rows inheritance tax thresholds — from 18 march 1986 to 5 april.

Source: www.zrivo.com

Source: www.zrivo.com

Federal Inheritance Tax 2024, Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2023 or $13.61.

Source: journals.sagepub.com

Source: journals.sagepub.com

Revenue, Redistribution, and the Rise and Fall of Inheritance Taxation, For instance, if you inherit a property initially.

Source: www.linkedin.com

Source: www.linkedin.com

INHERITANCE TAX RNRB EXPLAINED, This threshold is known as the nil.

Source: www.theprivateoffice.com

Source: www.theprivateoffice.com

Inheritance Tax Infographic The Private Office, 45 rows inheritance tax thresholds — from 18 march 1986 to 5 april.

Source: www.shortlands.co.uk

Source: www.shortlands.co.uk

Understanding Inheritance Tax Thresholds and Nil Rate Bands, Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2023 or $13.61.

Source: www.linkedin.com

Source: www.linkedin.com

Inheritance Tax in UK, Find the inheritance tax thresholds (or 'nil rate bands') from 1914, and see changes to inheritance tax interest rates from october 1988.

Posted in 2024